1

City of Sheboygan, Wisconsin

Tax Increment Financing (TIF) Policy

Adopted June 21, 2021

Sheboygan Tax Increment Financing Districts (TIDs)

2

Introduction

Tax Incremental Financing is a financing tool where cities can use the increased

property tax revenue from new development or redevelopment in an area (called

a TIF District or TID) in order to pay for public infrastructure projects or economic

development projects in the TID. TIF works by temporarily capturing a portion of

property tax revenues collected in the TID to pay for eligible project costs as

described in the TID project plan. When project costs have been repaid through tax

increments, the TID closes and the total value of properties in the TID are added to

the tax base of the city, county, and school district. TIF is the main economic

development tool available to Wisconsin cities.

Financial assistance from the City of Sheboygan TIF program for private

development or redevelopment projects shall be evaluated according to Wisconsin

law and this policy. Variations from this policy may be considered for projects that

provide extraordinary benefits to the community in terms of tax base, job creation

or retention, improvements to public infrastructure, or other advantages to the

Sheboygan economy.

The City of Sheboygan shall evaluate all requests for TIF assistance using the “but

for” standard and utilizing a financial gap analysis. Each project must demonstrate

that “but for” a TIF, the project would not be financially feasible. The financial gap

analysis should demonstrate the minimum amount of TIF assistance needed as gap

financing to make the project financially feasible.

The Common Council in its sole authority may approve or disapprove any TIF

requests as it deems appropriate. The goals, guidelines, and descriptions below

should not be seen as anything but goals and guidelines and do not bind the

Common Council in any way to approve or deny an individual request. Additionally,

approval or disapproval of any TIF request does not establish precedent obligating

the Common Council to approve or disapprove any future TIF requests.

3

Section 1: TIF Goals

1. Growing the property tax base.

2. Fostering the creation and retention of quality jobs for individuals of all

backgrounds and abilities.

3. Redeveloping blighted areas that are obsolete or detrimental to public

health and wellbeing.

4. Promoting infill development and redevelopment that can achieve highest

and best use of land.

5. Remediating contaminated brownfield sites.

6. Incentivizing the development of a range of workforce housing options that

can close the housing affordability gap.

7. Mitigating climate change and adapting to our changing environment.

8. Funding public improvements that enhance livability, improve the City’s

infrastructure, enhance the urban greenway, improve multi-modal

transportation options and access to employment areas, enrich aesthetics of

key areas and corridors within the City through the use of streetscaping and

art amenities, and boost the stormwater management capabilities.

9. Leveling the playing field for sites that are challenging to develop due to

extremely poor soil quality.

10. Implementing adopted City plans and policies, particularly the City’s

Comprehensive plan, Master plan and Neighborhood plans.

11. Ensuring that sufficient increment is available to fund public infrastructure

projects as described in TID project plans.

4

Section 2: TIF Policy Guidelines

1. Sheboygan will give preference to TIF assistance for projects that are

occurring on sites that are already developed (redevelopment projects) over

greenfield development projects which typically have lower costs.

2. All TIF considerations shall be consistent with approved TIF Project Plan(s)

(see Section 3).

3. If Sheboygan provides TIF assistance to developers, it will do so primarily

through developer-financed methods. Sheboygan may consider up-front TIF

incentives on a case-by-case basis where gap financing is required.

4. Sheboygan will consider TIF requests only after determining that “but for”

the TIF, the project would not be financially viable.

5. Sheboygan aims to minimize the percentage of increment applied to a

development project. Generally, the City of Sheboygan does not approve

increment financing for more than 15% of the project area’s total assessed

value.

6. For development projects that will include competitive funding resources

allocated by any state or federal agency, Sheboygan may evaluate TIF

assistance with the standards of the state or federal funding source and seek

to design incentives for job creation or retention. If economic incentives are

offered, there will be a job maintenance and lookback provision

requirement.

7. In special circumstances, Sheboygan may provide economic incentives for

job creation or retention. If economic incentives are offered, there will be a

job maintenance and lookback provision requirement.

8. Sheboygan will include lookback provisions on actual construction costs and

TIF-eligible expenses for all TIF agreements.

9. Sheboygan may require heightened design standards for TIF projects.

10. Developers shall pay TIF creation costs from TID consultant for site-specific

TIDs.

11. Developers shall make a good faith effort to work with local contractors on

development phase of the project.

5

Section 3: TIF Project Types & Costs

The following project types may be TIF eligible if they meet the City’s TIF Goals

(Section 1):

1. Projects that are consistent with the approved TIF Projects Plans.

2. Redevelopment projects, including but not limited to office, research &

development, medical uses, manufacturing, hospitality and leisure, housing,

and mixed-use projects.

The following project costs may be TIF eligible if they meet the City’s TIF Goals

(Section 1):

1. Public infrastructure necessary for the proposed project.

2. Demolition of existing structures for development projects.

3. Remediation of soils that are contaminated or remediation of soils that are

of poor quality for construction purposes.

4. Preservation and revitalization of historic buildings.

5. Structured parking that maximizes density on a site.

6. Extraordinary costs related to affordable housing development.

7. Whole building energy modeling (BEM) for new construction and building

retrofits.

8. Renewable energy, including solar photovoltaics, geothermal, and wind

energy.

9. Microgrid technology that can support renewable energy and energy

reliability.

10. Green roofs that include gardens that can capture and retain stormwater.

11. Blue roofs that capture and store stormwater to mitigate runoff effects.

12. Under-parking water retention systems that capture and store stormwater

to mitigate runoff effects.

13. Stormwater management best practices that are above the State mandate.

14. Purple pipe reclaimed water piping systems.

15. Site-specific public art projects.

6

The following project types are not TIF eligible

1. Developments that occur outside the TIF district.

2. Market rate housing on greenfield sites are not typically TIF eligible. Market

rate housing projects will be evaluated on a case-by-case basis and may be

considered for assistance to the degree they demonstrate a financial gap and

promote the City’s TIF goals articulated in Section 1.

3. Retail-only buildings on greenfield sites (retail stores, service-oriented

retailers like daycares, etc.).

4. Buildings that are already constructed.

5. Developments that are exempt from the payment of property taxes.

The following project costs are not TIF eligible

1. Land costs that exceed market land costs.

2. Ordinary or typical development costs that are normally provided in the

market for the type of land use that is being proposed or that are required

to meet City or State requirements or codes. Examples could include (but are

not limited to): 1) costs related to meeting code requirements; 2) costs

related to meeting City stormwater management requirements.

3. Energy efficiency improvements (including high-efficiency windows or

shadings, energy efficient appliances, LED lighting, enhanced insulation, etc.)

within a building. These are expected in all TIF projects but they are not TIF-

eligible costs.

4. City fees (impact, permits, park improvement, stormwater management,

etc.).

5. TIF may not pay for infrastructure that is normally paid for by special

assessments or other city charges.

6. Other costs that are deemed to be normal development costs.

7

Section 4: Application and Approval Process

1. Pre-Application Meeting: The developer shall meet with City staff to discuss

the project in concept including the need for TIF financing, potential TIF

eligible costs, project timeline, and economic benefits.

2. Application and Review Fee: If the developer wishes to proceed with a

request for TIF financing they shall submit a TIF request letter and completed

application form along with a TIF Review Fee of $1,000 which will be used to

cover the cost for staff and City consultants in reviewing the TIF request over

the 3-5-month review process. The TIF Review Fee is non-refundable.

Additional costs that arise during the application process will also be covered

by the applicant. These costs would cover any outside legal assistance,

outside financial assistance or other services. In submitting the TIF request

form, the applicant is agreeing to cover these and any other additional costs.

As part of the application, the developer shall submit a proforma for the

project showing the total sources and uses of funds, anticipated project

valuation, and projected rate of return.

3. Staff Review and Recommendation: The City’s TIF team will review the

request with assistance from the City’s consultants (TIF Consultant, City

Engineer, Financial Advisor, and City Attorney) and from the City Assessor as

needed. Depending on the complexity of the project, the developer may be

invited in for additional meetings with the City’s TIF Project Management

Team (PMT) or TIF staff.

4. Common Council Conceptual Review: The Common Council will meet to

review the TIF request. The Common Council may meet with the developer

in open session to ask questions regarding the request. The Common Council

will then have the opportunity to meet in closed session, as appropriate,

without the developer to discuss negotiations of the terms of the TIF

agreement. If appropriate, the Common Council may take a vote in closed

session and direct staff to start negotiating the developer’s agreement for

the project.

8

5. Common Council Conceptual Review: The Common Council will review the

terms and direction and Finance Committee recommendation and take

action on the conceptual approval of the terms of the TIF agreement.

6. Drafting of TIF Agreement: Following conceptual approval by the Common

Council, staff will work with the City Attorney to draft the formal TIF

agreement based on the terms and the direction of the Common Council.

7. TIF Agreement Approval: The TIF agreement shall be introduced at a

Common Council meeting and referred to the Finance and Personal

Committee. The Finance and Personal Committee will review the TIF

agreement and make a recommendation to the Common Council who shall

take action to approve or reject the agreement.

8. Lookback and Review of TIF-Eligible Costs: Following completion of the

project, the developer shall submit the final action sources and uses (costs)

for the project per the agreement. In addition, the developer shall provide

documentation of the actual amount of TIF-eligible costs. The amount of the

TIF incentive shall be limited to the actual amount of TIF-eligible costs.

Project Requirements

All developers requesting TIF assistance must demonstrate that:

1. The project is not financially feasible without the use of the requested TIF

funding.

2. The TIF request complies with Wisconsin statutes and the TIF District Project

Plan.

Project Evaluation Criteria

The following criteria will be used in evaluating requests for TIF assistance. Other

factors may be considered as well on a project by project basis.

• Does the project conform to existing plans and zoning?

• How does the project increase and improve the City’s tax base?

• What portion of the tax increment is applied to the project compared to total

TIF district?

• What is the economic impact of the project including job creation and

retention?

9

• Does the project support the City’s affordable housing and sustainability

goals?

• What impact would the project have on current City business?

• What are the qualifications of the developer and the development team?

• What level of private equity and financing is included in the project budget?

• Does the project rely on reasonable assumptions of real property value

increases?

• Would the proposed project assist in achieving other policy goals established

by the Common Council?

10

City of Sheboygan, Wisconsin

Tax Increment Financing (TIF) Request Application Form

Please complete and submit the following information to the Department of

City Development for a more detailed review of the feasibility of your request

for Tax Increment Financing (TIF) assistance.

Applicant Information

Name of Applicant: ________________________________________________

Business Name and Address:________________________________________

________________________________________________________________

________________________________________________________________

Primary Contact: __________________________________________________

Phone Number: ___________________ Email Address: ___________________

Type of Business Entity: ____________________________________________

Property Information

Address of the Proposed Project: _____________________________________

Parcel Number(s):_________________________________________________

Currently, does the applicant own or lease the property? (Check one)

____Owner ____Renter ____Neither

At project completion, will the applicant own, lease or convert the property to

condo ownership? (Check one)

____Own ____Lease ____Convert to Condo Ownership

11

At project completion, who will occupy (operate business on) the site? (Check

one)

____Owner ____Renter ____Both

If the applicant is the current or prospective tenant of the property, attach a

description of the premises to be leased (legal description, floor plan, etc).

Evidence of Site Control

A. If the Applicant owns the project site, attach a copy of the applicant’s deed. Also

indicate: Mortgage Holder(s): ______________________________________

B. Total annual mortgage payment (principal & interest): $___________________

C. Total outstanding balance of existing mortgage(s): $______________________

A. Name, address, and phone numbers of other persons or entities having an

ownership interest in the property to be redeveloped, if applicable:

B. If the Applicant has a contract or option to purchase the project site, attach a

copy of the purchase or option contract. Also indicate:

Date Contract was signed: _______/_______/________

Closing/expiration date: _______/_______/________

C. If the Applicant currently leases or will lease the project site, attach a copy of the

lease or lease option contract. Also indicate:

Legal name of Owner as noted on the deed(s):_____________________________

Name of person who signed lease for Tenant (lessee): ______________________

Landlord/Owner’s name and address: ____________________________________

___________________________________________________________________

Owner Affidavit: If the applicant leases or plans to lease the property, have the

owner (and all entities having ownership interest in the property) sign an Owner’s

Consent Letter.

12

Project Description

Describe the project and proposed use:___________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

Is the proposed project consistent with the existing zoning of the property?

(Check One) ____Yes ____No

If no, what zoning change will be requested? ______________________________

___________________________________________________________________

Land Area (acreage) of project site:

Current: ________ acres

Proposed: _________ acres.

Building Area in square feet or Acres (circle the unit you used) of project building

Gross Net Leasable

Current: ____________ Sq. Ft / Acres _____________Sq. Ft / Acre

Proposed: ____________Sq. Ft / Acres _____________Sq. Ft / Acre

Number of Stories___________ Number of Units ___________

13

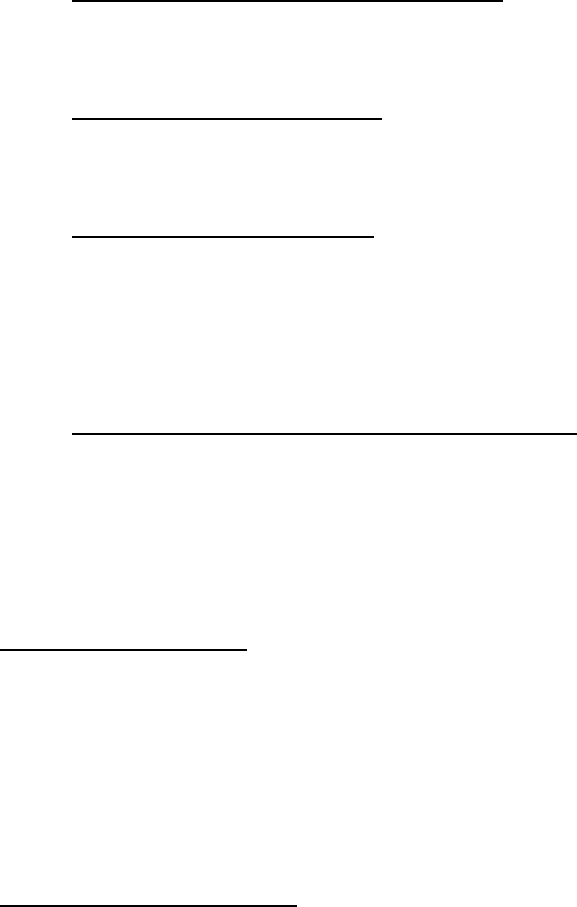

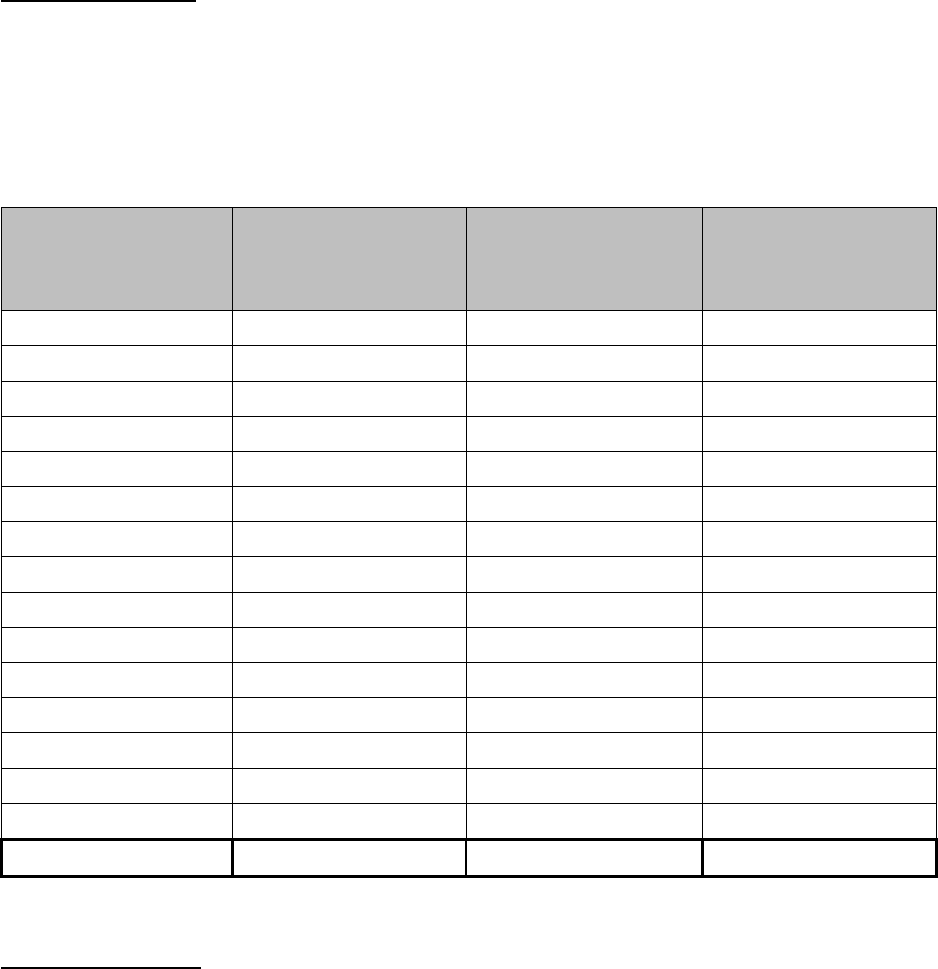

Residential Unit Breakdown

Unit Type

# of

Units

# of

Bedrooms

Avg. Sq.

Ft.

Avg. Rent

Avg. Sale

Price*

A

B

C

D

E

*If condo project

Utilities included in apartment rent (check all that apply):

None ______ Electric _____ Heat _____ Other (Specify): _______________

Additional Costs

Parking ______ Storage______ Other (Specify): ____________________

Job Creation and Retention Information

List the current projected number of part-time and full-time jobs in the City of

Sheboygan before and after completion.

Current Jobs

Projected

Jobs

Average

Wages/Salary

Average Total

Compensation

Full-Time

Part-Time

Total

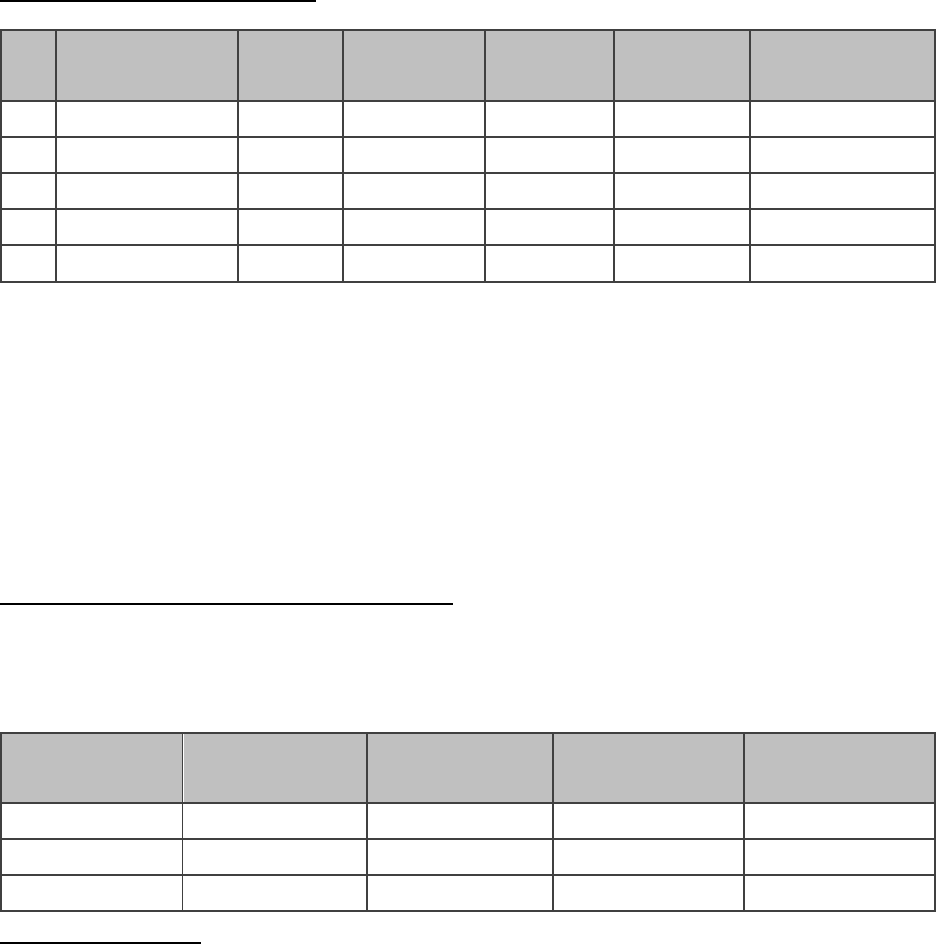

Projected Budget

Type of assistance being requested: (Check One)

Developer-Financed TIF Incentive ___

City-Financed (Upfront) TIF Incentive ___

Waiver of Impact Fees (For affordable housing projects) ___

Other (Describe): _______________________________________________

14

Indicate the total amount of TIF assistance requested: $ _____________________

Anticipated assessed value of the project at completion: $ ___________________

Project Budget Sources and Uses of Funds

SOURCE OF FUNDS

AMOUNT

Private Financing

Secondary Financing

Developer Equity

Investor Equity

Grants

TIF Assistance

Other:

Other:

Other:

TOTAL SOURCES

USES OF FUNDS

AMOUNT

Property Acquisition

Demolition

Environmental

Public Infrastructure

Hard Construction Cost

Architect & Engineering fees

Other Soft Costs & Permits

Financing Costs

Development Fee

Contingency

Other:

Other:

TOTAL COSTS

Please attach a detailed project proforma showing projected revenues,

expenditures, net operating income, and anticipated after-TIF rate of return.

15

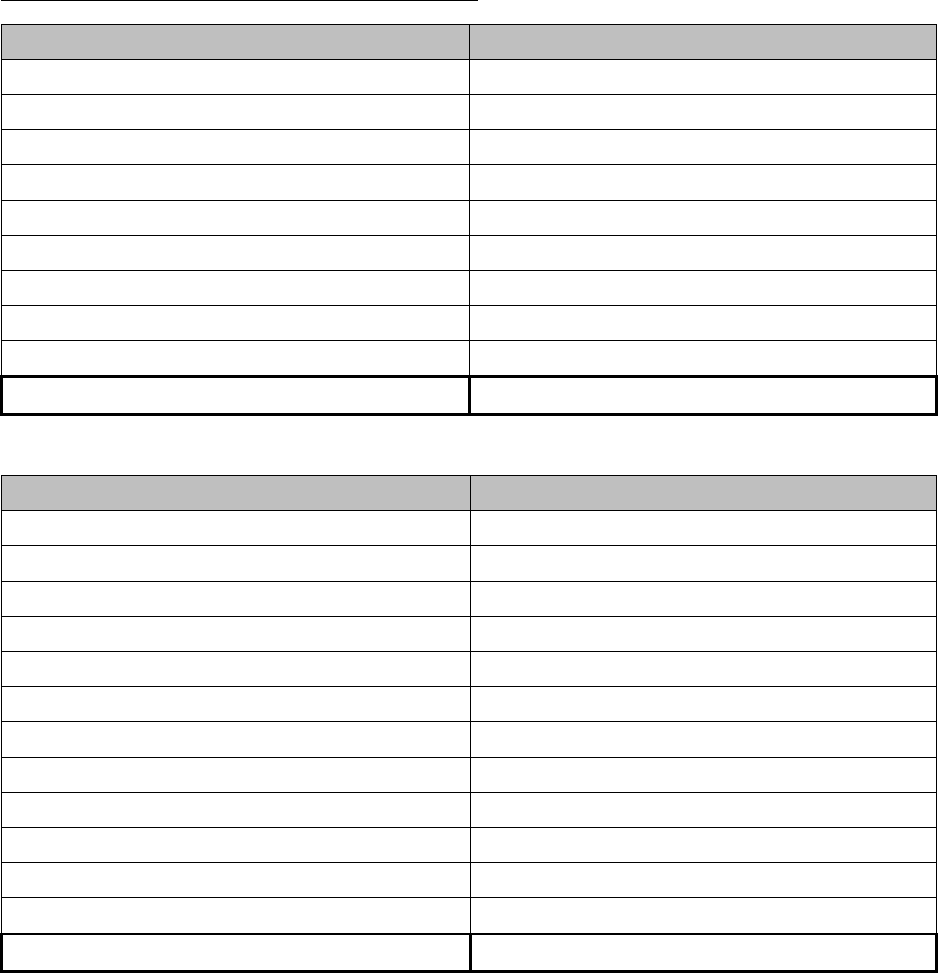

TIF-Eligible Costs

Only extraordinary costs beyond those of a typical development will be

considered as potential TIF-eligible costs. For each item where TIF funding is

requested list the total estimated cost of the item, the normal development cost,

and the portion of the cost that is being requested for TIF funding.

Item

Total Cost

Estimate

Normal

Development

Cost

Requested TIF-

Eligible Cost

Total

Project Financing

Private Financing Lender: ______________________________________________

Loan Amount $ ___________________ Interest Rate:__________

Preapproved? Yes____ No____

TIF Loan Lender: ____________________________________________________

16

Loan Amount $___________________Interest Rate: ___________

Preapproved? Yes____ No____

If yes, what programs:________________________________________________

___________________________________________________________________

Application status:___________________________________________________

___________________________________________________________________

Likelihood of award:__________________________________________________

___________________________________________________________________

Other funding: ______________________________________________________

Signature

I, the undersigned, affirm that the project descriptions, numerical and financial

estimates, and all other information I have provided in this application are true

and complete to the best of my knowledge. I have read and understood the

requirements described in this application. I understand this application and the

supporting documents are considered public records and may be subject to

disclosure under Wisconsin’s Public Records laws. Furthermore, I certify that I am

authorized to initiate the TIF application process on behalf of the project

described. I agree to cover any and all costs involved in processing this

application.

Signed: _____________________________ Date: _____________________

Title: _______________________________

Legal Disclaimer

Completion of this application does not entitle the applicant to financial

assistance. Any such assistance must be approved by the appropriate City boards,

committees, authorities, and the Common Council.

17

Please attach:

• A letter describing the project, its impact, and the need for TIF assistance.

• A detailed proforma showing projected revenues, expenses, net operating

income, and the after-TIF assistance anticipated rate of return (see

example).

• Loan pre-approval or commitment letter (if applicable).

A non-refundable TIF application fee in the amount of $1,000 is required with

this application to reimburse the cost of City TIF staff and consultants in

reviewing the TIF request.

*The Developer will be responsible for the creation cost of any site-specific TIF.