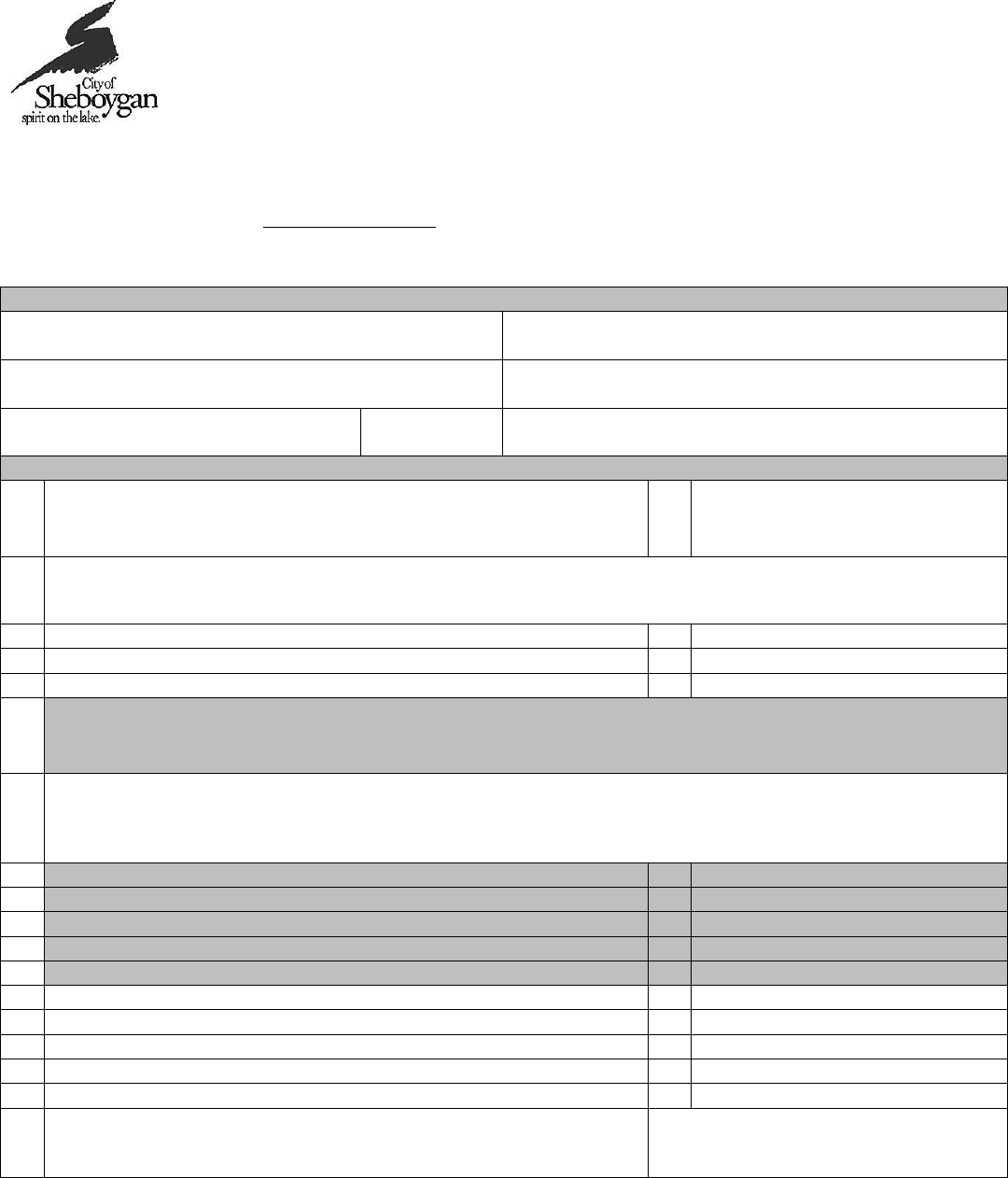

Quarterly Hotel/Motel Room

Tax Reconciliation Form

Pursuant to Sheboygan Municipal Code §114-38 Hotel-Motel Room “tax imposed for each calendar quarter is

due and payable on the last day of the month next succeeding the quarter for which imposed.”

Make check payable to the City of Sheboygan. Mail to City of Sheboygan Finance Department, 828 Center

Avenue, Sheboygan, WI 53081

PART 1: Property and Owner/Preparer Information

Name of Lodging Property:

Permit Number:

Lodging Address:

Report Quarter/Year:

Name of Lodging Property Contact:

Phone #

Email Address:

PART 2 – Monthly Room Tax Report

1

GROSS LODGING SALES: Report ALL Lodging Revenue from ALL revenue

sources (DIRECT BOOKINGS and Lodging Marketplace Providers) including taxable

fees, charges and exemptions – excluding tax for the report month. (If you have sales

through a Lodging Marketplace Provider you will also need to complete section 7)

1

$

2

ALLOWABLE EXEMPTIONS: This line is only to be used to claim tax exempt lodging sales – Enter Non-Taxable Sales. This line is

not to be used to back out other taxes or service fees. ** If claiming tax exempt lodging you must provide the CES# information. If you need

additional spaced to enter CES#’s, please add a page.

2a.Total Allowable Exemptions: CES#

2a

$

3

NET TAXABLE SALES: (line 1 minus line 2a)

3

$

*4

Tax Due – 8% rate (line 3 x .08)

4

$

5

PAYMENTS MADE ON YOUR BEHALF: If you rent through a marketplace provider who collects tax on your behalf, include

the revenue in your Gross (line 1) and on line 5a enter gross sales for all marketplace providers. Below, report how much room tax was paid

on your behalf by each marketplace provider. Failure to provide payment information will deem room tax delinquent and late fees and interest

will be assessed.

5a. Total Lodging Market Provider Sales that Room Tax was COLLECTED – enter total gross sales for

all lodging marketplace providers for which room tax was collected

$_____________________________

(checkpoint = 5a total x 8% must = line6)

5b. Airbnb

5b

$

5c. VRBO/Homeaway

5c

$

5d. Expedia Collect

5d

$

5e. Booking.com

5e

$

5f. Other Marketplace Provider – Name__________________

5f

$

6

Total Payments Made on your behalf (sum of lines 5b – 5f)

6

$

*7

NET TAX DUE (line 4 – line 6)

7

$

8

Late Filing Penalty:$25.00

8

$

9

Late Filing Interest (1% per month)

9

$

10

TOTAL AMOUNT DUE (sum of lines 7 – 9)

10

$

Signature:

Date:

*Delinquent tax returns shall be subject to a $25.00 late filing fee. (Sheboygan Municipal Code §114– 43)

**If a person required to make a return under this article fails, neglects, or refuses to do so, the finance director/treasurer may determine the tax due under

this article according to his or her best judgment and may require that person to pay the amount of taxes the finance director/treasurer determines to be due

plus interest at the rate of one percent per month on the unpaid balance. No refund or modification of the payment determined may be granted until the

person files a correct room tax return and permits the city to inspect and audit his or her financial records. (Sheboygan Municipal Code §114-41)

Last modified 8/15/2018

City of Sheboygan Quarterly Room Tax Report Instructions

Line 1 GROSS LODGING SALES: Enter the total amount of lodging sales (including direct bookings and

lodging marketplace providers) for the reporting period taxable items such as, traveler service fees,

cleaning fees, etc. and charges which are exempt from room tax. This total should have not sales or

room tax included. This total includes all sources of bookings for your property.

Line 2 EXEMPT SALES: This line is only to be used to claim tax exempt lodging sales - Enter Non-Taxable

Sales. This line is not to be used to back out other taxes or service fees. If claiming tax exempt lodging

you must provide and keep on record the CES# information as outlined by the WI DOR PUB 219.

Failure to provide exempt tax information will deem room tax delinquent and late fees and interest will

be assessed.

Line 3 Subtract line 2 from line 1

Line 4 Tax Due: Calculate the tax due at 8% (line 3 x 0.08)

Line 5 Payments Made on Your Behalf: If you rent through a marketplace provider who collects tax on your

behalf, include the revenue in your Gross (line 3) and on line 7a enter gross sales for all marketplace

providers. Below, report how much room tax was paid on your behalf by each marketplace provider.

Failure to provide payment information will deem room tax delinquent and late fees and interest will be

assessed.

Line 5a Enter the sum of all your marketplace lodging sales - this is a checkpoint field to balance against the

total tax paid on your behalf.

Line 5b-f The City of Sheboygan will require permit holders who utilize marketplace providers who collect room tax to report

how much room tax was paid on your behalf. This information is necessary is because we receive one bulk check

for properties that utilize these services. The City of Sheboygan is not given information as to what property is

being paid on. The online companies tell us that it is confidential information between the owner and the platform,

therefore they will not supply any information along with bulk payments. Collecting this information allows your

room tax to be distributed back to the municipality in which it was collected. Failure to provide payment

information will deem room tax delinquent and late fees and interest will be assessed. HOW TO: For EACH

platform you will enter the tax paid on your behalf for the report month on the designated report line.

Line 6 Total the amount of payments made on your behalf (Lines 5b-7e) - this must balance to the tax due on

5a.

Line 7 Total Net Tax Due (lines 4 – 6)

Line 8 If filing late please add $25.00 – reports should be filed timely with the Finance Department to avoid the

late filing fee.

Line 9 Interest due at the rate of 1% per month on the unpaid room tax due.

Line 10 Total Amount Due: Sum of lines 7 – 9.